The impact of the 2007-2008 Global Financial Crisis on China had been balanced out by a huge stimulation package valuing 4 trillion RMB (13 % of GDP, Ebbers 2019: 90) from the central government side. On top of this, virtually boundless credits to local governments must be taken into account. These measures blocked the progress of structural reforms begun in the mid-2000s. The Chinese economy continued to suffer from overinvestment, low domestic consumption, an underdeveloped service sector, regional inequalities, and environmental degradation and pollution.

Air pollution was of particular interest to the global public during the 2008 Olympic Games and the Expo 2010 in Shanghai, but continued to dominate discussions throughout the 2010s. Part of the problem is the high share heavy industry occupies in the productive sector of the economy, and another one the abundancy of cheap coal in north China. Compared with the United States, consumption of oil is only half, but China is one of the most energy-intensive economies of the world (Ebbers 2019: 85). Enforcement of environmental law is difficult on the local level (while it had been apparently easy to shut down Beijing factories during the Games), and some actors point at the responsibility of foreign companies producing in China. China would need more time, and is still not having the necessary funds to invest in environment protection – a phenomenon called the "environmental Kusnets Curve" (only a certain degree of public wealth allows countries to tackle problems of environment and resources).

The inactivity of the Hu/Wen administration was indirectly criticized by Prime Minister (incumbent since 2013) Li Keqiang 李克强 (b. 1955), who said that "reform is like sailing a boat against the current; if you don't move forward, you will be pushed backward" (gaige ru nishui xing zhou, bu jin ze tui 改革如逆水行舟,不进则退). The resolution of the Third Plenum of the 18th Central Committee (Zhonggong di shiba jie Zhongyang Weiyuanhui di san ci quanti huiyi 中共党第十八届中央委员会第三次全体会议) in November 2013 was a very concrete list of problem areas to be dealt with and which measures were to be taken. The reforms postponed by Hu Jintao and Wen Jiabao would have to been approached.

| 经济制度 economic system |

State-owned and private economy as parts of the socialist market economy; protection of private and state-owned property; integration and support of both types of ownership |

| 市场体系 market system |

Prices are determined by the market, rare interference by the government; transparency and universality of market rules; gradual release of price control over water, oil, gas, electricity, traffic. Rural communes have freedom in the use of soil; permission to create private banks |

| 政府职能 administrative efficiency |

Creation of trustworthy, reliable, law-conforming administration to serve the people |

| 财税体制改革 financial system |

Moderate strengthening of the central government’s duties and responsibilities in revenues and spending; creation of an early-warning mechanism; financial transfers to backward regions; gradual increase of direct taxes on 'problematic' (waste, pollution) products; reform of taxes on property, real estate, and natural resources consumption tax; adjustment of finance distribution between central and local governments |

| 城乡一体化 urban-rural divide |

Most peasants (guangda nongmin 广大农民) can enjoy the fruits of modernization; farmers shall be granted all rights of soil ownership, use, mortgage, and transfer of all entrepreneurial rights, including building areas; strict control of taking up residence in large cities in favour of the expansion of mid-size cities and towns |

| 开放型经济 "open economy" |

Widening investment possibilities, also by providing a better legal framework for foreign investment; expanding the number of free-trade zones (ziyou maoyi qu 自由贸易区); creating better access lines to interior regions; liberalization of passenger traffic and movement of goods in border regions; intensification of exchange with Hong Kong and Macau |

| 政治制度 political system |

Creation of better mechanisms of legislative drafts, discussion, and coordination, in order to raise the quality of legislation and to prohibit local and ministerial domination; strengthening the control of the National People’s Congress over the budget ; realization of financial regulations; advancement of basic democracy on the local levels by elections, meetings, promulgations, offerings of positions, etc. |

| 法治建设 legal system |

Preserving the authority of constitution and laws; people shall feel being treated fairly in each court and have the right to consult advocates; creation of a monitoring system checking the conformity of public documents with the law; reduction of administrative levels; strengthening the legal control of food, medical objects, labour safety, environment protection, etc.; legal and public law suits; strict prohibition of torture in questioning, reduction of verdicts pronouncing the death penalty; abolition of re-education by labour and replacement by a healthy legal framework |

| 反腐败 corruption |

Stricter control and supervision of the activities of cadres; strengthening of control of lower levels, and improving the report system in intra-party investigation cases; improving the living conditions of leading cadres and ban of sideline earnings |

| 文化体制改革 culture |

Change from culture making to culture administration (persons, funds); readjusting and integration of online and traditional media; lowering the threshold for private investment in culture and publication |

| 社会事业改革 social affairs |

Standardization and harmonization of the school and examination system; reform of the salary system in the public service; lowering and adjusting social insurance fees; delaying the age of retirement; lowering prices for medical services; expanding the types of treatment included in medical insurance; end of the one-child policy for children without brothers and sisters |

| 创新社会治理 new 'interaction' with society |

Strengthening the work with private social organizations; improving the petition system; enhancing control over food and medicals control; creation of institutions to ameliorate national security |

| 生态文明 environment |

Creation of a systematic approach to civilized environment protection; end of production quotas for zones of restricted development and poor districts and such with fragile environment; compilation of drain charts for natural resources; auditing of cadres concerning natural resources; remuneration for reduced use of resources; improvement of the environment protection system |

| 国防和军队 defence |

Adjustment of the proportions of weaponry, armed forces and organization; reduction of non-combatants; strengthening the clout and command structure of the armed police; deepening the budget, payment, supply, medical services, insurance, and housing of the troops; enlarging the supply base from private producers |

| 党的领导 Party leadership |

Strengthening the authority of the centre, securing the flow of directives from the small leadership groups, which are responsible for overall planning, adjustment, promotion, and realization; matching duty with rank, in order to facilitate promotion, especially in difficult regions; adjustment of the relationship between centre and province, the whole and specific parts, short-term and long-term aspects |

Source: Zhongyang quanmian 2013. |

|

The tenor of the points listed is the need of structural change, yet the list is so long and complex and touches so many elements that are in a permanent flux. This mélange is made more opaque by General Secretary Xi Jinping's idea of the "China dream" (Zhongguo meng 中国梦). The reality of China's de-facto market economy is a situation of multiple independent centres challenging the authority of the central government over interpretive dominance. Nonetheless, the structure of China's economy is still too much centralized, and the development of independent regulatory institutions is lacking behind the requirements of the economy.

The Twelfth Five-Year Programme (2011-2015) envisaged "inclusive growth" (baorongxing zengzhang 包容性增长) of the economy the growth which stood at that time at about 6.7 % p.a. (Ebbers 2019: 77) and remained relatively stable thereafter until the 2020-21 Covid-19 Crisis.

The Thirteenth Five-Year Programme, covering the years 2016-2020, envisaged more sustainability, spending in healthcare, education, and pensions, balancing out of the trade surplus, reduction of overinvestment (high cost, low returns, financed by savings) which stood at c. 32 % in 2010-2014, but thereafter rose again (Ebbers 2019: 79), curbing the declining efficiency of resource use, and reducing debt accumulation.

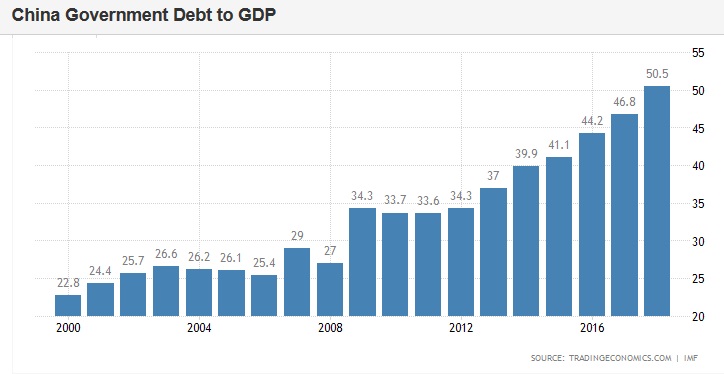

The ratio of overall debt to GDP stood at 280 % in 2016 (Ebbers 2019: 89), and rose to over 300 % in 2019 (Lee 2019), which is extremely high in relation to GDP per capita. In the same year, government debt of all levels was no less than 40 trillion US$, which is 15% of overall global debt (Lee 2019). The immense debt burden can be traced back to the fiscal stimulus after 2007 during which state-owned enterprises (SOE) and local governments were given free hand in lending, but were not controlled as to the use of credit. The result was a huge liquidity surplus which was invested in infrastructure or production sectors not able to play out their full capacity. China suffers from overcapacity in many sectors.

|

Source: Tradingeconomics.com |

Some observers are not convinced that there is indeed overinvestment in China because the capital stock (total value of fixed and liquid assets) per capita is still relatively low in comparison with other industrial states. Moreover, the hinterland and smaller cities are still underdeveloped and demand investment in basic infrastructure, much in contrast to the rich coastal cities. One must not forget that 43% of the population is still living in the countryside (Ebbers 2019: 102).

A particular problem is that quite a few investments are made in support of loss-making "zombie" SOEs and unnecessary local projects. Yet on the other hand, it is a general plan of provinces (going back to the 1950s and the Great Leap) to become economically self-sufficient, and each province therefore builds up its own infrastructure. This procedure caused the creation of duplicity in many industrial sectors, like alum, steel, bicycles, solar panels, flat glass, shipbuilding, cement, refining, or automotive. The outcome is inter-provincial competition, along with low capacity utilisation in some sectors of only 60-70 % (Ebbers 2019: 108-109).

Yet the reduction of overcapacity is difficult because it would raise unemployment, deprave the government of control over some sectors dominated by SOEs, and put problems onto banks which are expecting repayment of debts of low-profit enterprises.

The financial market itself has not made substantial progress since 2000. Just as the industrial state sector, state banks continue enjoying protection from competition. The liberalisation of the financial market is only carried out very hesitatingly. Yet there are more specific problems in this field. Artificially low deposit rates and high private savings allow for cheap credits and boost economic growth, at least to SOEs, while private enterprises pay substantially higher lending rates. Another obstacle in the financial system is the rule that land cannot be used as mortgage because private land ownership is not allowed in agriculture. Many communities therefore are aspiring classification as "urban", which would allow them to use land as a veritable commodity.

While the stock market is increasingly being opened, corporate ownership is an issue still to be improved, for instance, making easier the financial tool of private equity. Such a step might profit private firms, while there remains the danger for SOEs that private investors will shy away to invest in Party-dominated business.

Not just the banking sector, but also other parts of the Chinese economy are protected from competition. SOEs enjoy practically unconditional government support by preferred access to bank credit and their informal relationships (guanxi) to the Party. This is even true for some superficially private enterprises like Huawei. The service sector with the segments banking, insurance, telecommunications, transportation, retails, hospitality, tourism, healthcare and real estate business surpassed in 2012 the manufacturing sector in its contribution to GDP, but is closed for new domestic market entrants and foreign-invested enterprises (FIE) as well. The keeping away of foreign direct investment (FDI) from certain business segments may prevent the creation of spill over effects and blocks competition. Opening up markets would in the long run lead to higher quality in manufacturing and the service sectors.

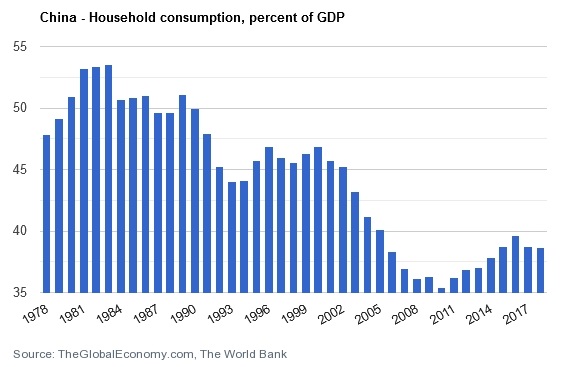

A further continuing problem of the Chinese economy is domestic consumption which is currently growing at a pace of 8 % p.a., just slightly over GDP growth. It will thus take some time until domestic consumption, nourished by the emerging middle class, plays an important role in economic performance. Yet the dimension of household consumption may be understated to some extent because it is statistically difficult to capture how much overturn is achieved in the ascending field of e-commerce.

|

Source: The Global Economy.com |

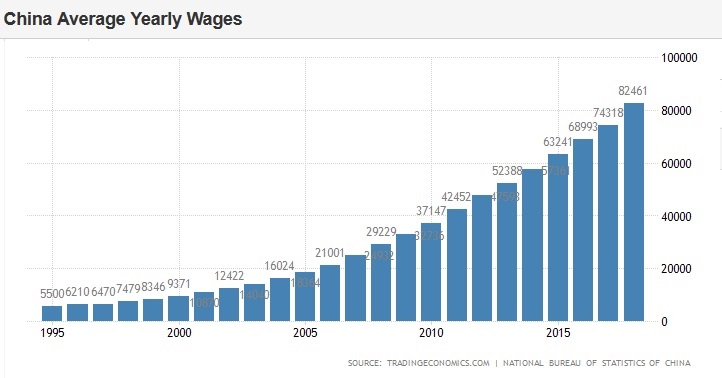

Private consumption also depends on the wage structure and some important aspects of social security, namely healthcare, pensions, and education. These fields are in turn related to the employment structure. China hesitates to abolish the traditional hukou system which discerns between urban residents enjoying privileges in social security and local schooling, and rural residents which have to do without these privileges, even if living and working in cities. The abolishment of the discriminating hukou system would be a pull factor for rural labourers to come to the cities and accept moderate wages for enjoying the privileges of social security allowed to urban residents.

|

Source: Tradingeconomics.com |

China with its huge population needs constant economic growth to provide jobs and allow for wage growth. Widespread social unrest would endanger the Party's credibility. The impact of the 2020-21 Covid-19 Crisis on the labour market (unemployment, sinking wages, inflation) is - as far as can be seen in early 2021 - modest, due to the regime's rather quick (if ignoring the initial delay of the news) and harsh reactions to contain the spread of the pandemic.

In 2013, a quarter of urban employees worked in government institutions and SOEs, 22 % in private enterprises, 8 % in foreign-invested enterprises (FIE), and 13 % in new corporate firms (modern limited-liability, joint-stock, and other idiosyncratic forms of enterprises) (Naughton 2018: 212).

As a developing country, China is facing the challenge of the middle income trap. It might escape the middle income trap by transgressing from the method of economic growth by labour-intensive, low-cost production and using of technologies from abroad to a mode of competition in high value-added industries based on R&D and higher education, as well as high-value services.

In order to achieve this transgression, robust structural reform is necessary. This reform includes the expansion of free-market principles with competition, as was defined according to the 3rd Plenary Session of the 18th Central Committee in 2013 by highlighting the "decisive role of the market in resource allocation" (shichang zai ziyuan peizhi zhong qi juedingxing zuoyong 市场在资源配置中起决定性作用). Yet the CPC is only willing to realize this role by continuing its time-tested gradualist approach in order to protect SOEs and not lose control over the economy. This attitude will, also in the long run, lead to a unique asymmetrical market liberalisation, in which the product market is practically liberalised in total, while the service sector and production factors (ground, capital, and to a certain extent also labour) are still under control of the Party.

Market reforms necessary to escape the middle income trap include the promotion of science and technology and investment in R&D, the integration of all social classes towards free social mobility, pragmatism over ideology, the rule of law (whereas the CPC continues to follow the principle of rule by law), modernization of the educational system, and a peaceful environment (that is perhaps threatened by Xi Jinping's increasing aggressiveness towards the US, Taiwan and other states not willing to comply).

Input of labour and capital are not the only means to increase production. A third factor is total factor productivity, which is usually equalled with technology and knowledge. For this reason the Chinese leadership has decided to launch the Made in China 2025 project that focuses on leaving the status of the "factory of the world" and becoming a country where high-tech is not just manufactured, but also invented and designed. In other words, the Chinese economy was hitherto contributing just a low value-added share in manufacturing while the highest component of added value was design and R&D contributed by foreign countries. The National Medium- and Long-Term Program for Science and Technology Development (Guojia zhong-changqi kexue he jishu fazhan guihua gangyao 国家中长期科学和技术发展规划纲要, 2006-2020) aims at rising investment on R&D from 1.8 % to 2.5 % of GDP in 2020 (Ebbers 2019: 106) to move up the global value chains. Seven strategic emerging industries were to serve as key growth industries contributing 15 % to GDP in 2020 (from 4 % in 2010, Ebbers 2019: 106). The fields concerned were information technology, robotics, green energy and green vehicles, aerospace equipment, ocean engineering and high-tech ships, railway equipment, power equipment, new materials, medicine and medical devices, and agricultural machinery.

The dependency on Chinese manufacturing in the medical sector globally became evident during the Covid-19 Crisis. In the future, many countries might therefore withdraw certain parts of their business in China in order to get around this trap.

Overcapacities should be reduced by increased investment in construction projects abroad. The initiative for this project was launched in 2013 in Astana, Kazakhstan, as One-Belt One-Road Project (yidai yilu 一带一路), also called Belt-and-Road Initiative (BRI) or New Silkroad Project and directed Chinese investment to Central Asia. The project was expanded soon and led Chinese infrastructural investment to Southeast Asia (to create the New Maritime Silkroad), Africa, Europe, and even South America. The creation of transport routes in turn allowed cheap shipment along naval, railroad and highway tracks to many parts of the world. The project was accompanied by the creation by China of the multilateral Asian Infrastructural Investment Bank (AIIB, Ch. Yazhou jichu sheshi touzi yinhang 亚洲基础设施投资银行, short Yatouhang 亚投行) which aims at circumventing the US-dominated institutions of the International Monetary Fund (IMF) and the World Bank.

One of the most important issues not resolved yet is the equal treatment of foreign investors. Even if acknowledging that the Chinese leadership has to steer a difficult path of pacing reforms not too slow, neither too fast, there is definitely the need to open the market further in order to comply with the principles of open and equal trade. While Chinese firms have free access to foreign markets, FEI are restricted in many market sectors, and SOEs are heavily subsidized. On the other hand, some European countries and the US are considering carrying out more immediate control over the acquisition of domestic firms by Chinese enterprises.

During the 2010s, the Chinese economy expanded globally in an unseen dimension. A large number of projects were launched to actuate the transgression from a labour-intensive economy to a high-tech economy. This field is certainly an efficient approach to engage the problem of China’s environmental degradation, but only one small step to restore an acceptable condition of the ecosystem.

Behind all the large projects launched since the beginning of the Xi/Li administration, the issue of social equality – once held high in Hu Jintao's slogan of the "harmonious society" – and the enhancement of social security still seem to have a long way to go.